“TAXING HARM TO SAVE LIVES: WHO LAUNCHES GLOBAL PUSH TO CURB CHRONIC DISEASES BY 2035”

In a decisive push to combat the global surge of noncommunicable diseases (NCDs), the World Health Organization (WHO) has unveiled the “3 by 35” Initiative, urging countries to raise the real prices of tobacco, alcohol, and sugary drinks by at least 50% by 2035.

The move, recently announced on WHO official website, aims to reduce harmful consumption, ease pressure on overwhelmed health systems, and generate critical revenue for public services.

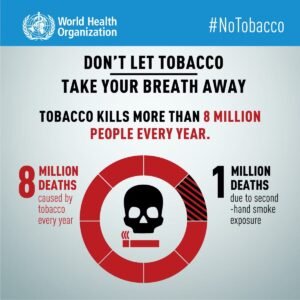

According to WHO, NCDs such as heart disease, diabetes, and cancer now account for over 75% of all deaths worldwide— a toll driven in large part by unhealthy consumption habits. The Initiative comes at a pivotal moment when countries are facing rising disease burdens, declining development aid, and unsustainable debt levels.

According to WHO, NCDs such as heart disease, diabetes, and cancer now account for over 75% of all deaths worldwide— a toll driven in large part by unhealthy consumption habits. The Initiative comes at a pivotal moment when countries are facing rising disease burdens, declining development aid, and unsustainable debt levels.

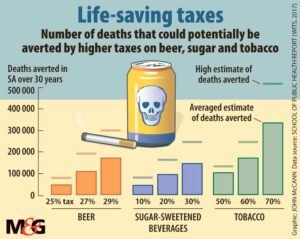

The “3 by 35” strategy is backed by new data showing that a one-time 50% increase in the price of tobacco, alcohol, and sugary drinks could prevent 50 million premature deaths over the next 50 years. Such health taxes have proven to be among the most cost-effective tools in reducing consumption and raising funds for essential services.

WHO’s Assistant Director-General for Health Promotion and Disease Prevention and Control, Dr. Jeremy Farrar, said “Health taxes are one of the most efficient tools we have”. He noted that such an act could create revenue for governments, and can reinvest in health care, education, and social protection. It

The initiative has set a target of mobilizing $1 trillion over the next decade, helping countries move toward more self-reliant and domestically funded health systems. Between 2012 and 2022, nearly 140 countries increased tobacco taxes, successfully raising real prices by over 50% on average, a demonstration that wide-scale reform is not only feasible, but effective.

Countries like Colombia and South Africa have already witnessed positive results, with reduced consumption and increased public revenue. However, WHO warns that many governments still offer tax incentives to unhealthy industries, undermining national health efforts and long-term development goals.

Led by WHO, the “3 by 35” Initiative brings together a global coalition of partners, including policy experts, civil society, and academic institutions, offering technical support and advocacy. The goal is to build strong multisectoral alliances, particularly between ministries of health and finance, to implement policies that are both politically feasible and socially impactful.

The initiative outlines three key action areas:

- Reduce harmful consumption by increasing excise taxes to make unhealthy products less affordable;

- Raise domestic revenue to fund essential health services and universal coverage;

- Build political momentum by engaging cross-sector stakeholders and the public.

The Initiative is global, but tailored support will be provided to countries seeking guidance on how to implement smart taxation policies. Many governments have already indicated interest in transitioning toward fairer, more sustainable health financing models.

Dr. Farrar emphasized the broader implications, stating that “This is not just about cutting back on harmful habits; it’s about building healthier, more equitable societies.”

With NCDs continuing to surge and public finances under strain, WHO is urging governments, civil society, and development partners to commit to smarter taxation policies that protect health while advancing the Sustainable Development Goals (SDGs).

The message is clear: higher taxes on tobacco, alcohol, and sugary drinks are not just a health intervention, they are a lifeline.